An Unbiased View of Amur Capital Management Corporation

An Unbiased View of Amur Capital Management Corporation

Blog Article

The 8-Minute Rule for Amur Capital Management Corporation

Table of ContentsHow Amur Capital Management Corporation can Save You Time, Stress, and Money.5 Simple Techniques For Amur Capital Management CorporationThe smart Trick of Amur Capital Management Corporation That Nobody is Talking AboutUnknown Facts About Amur Capital Management CorporationThe 3-Minute Rule for Amur Capital Management CorporationAll about Amur Capital Management Corporation

This makes actual estate a rewarding long-term investment. Genuine estate investing is not the only means to spend.

The 7-Minute Rule for Amur Capital Management Corporation

Considering that 1945, the ordinary big supply has returned close to 10 percent a year. That said, stocks can just as quickly diminish.

That stated, genuine estate is the polar opposite relating to specific facets. Web incomes in genuine estate are reflective of your very own activities.

Stocks and bonds, while frequently abided together, are basically various from one another. Unlike stocks, bonds are not representative of a stake in a firm.

All about Amur Capital Management Corporation

The real advantage property holds over bonds is the time frame for holding the investments and the price of return throughout that time. Bonds pay a set price of rate of interest over the life of the investment, thus purchasing power with that passion goes down with rising cost of living in time (investment). Rental building, on the various other hand, can produce higher rents in durations of greater inflation

It is as straightforward as that. There will always be a demand for the precious steel, as "Fifty percent of the world's populace counts on gold," according to Chris Hyzy, primary financial investment officer at united state Depend on, the personal wide range management arm of Financial institution of America in New York. According to the Globe Gold Council, demand softened last year.

Rumored Buzz on Amur Capital Management Corporation

Consequently, gold costs need to return down-to-earth. This must attract developers seeking to take advantage of the ground level. Identified as a relatively risk-free asset, gold has actually established itself as an automobile to raise investment returns. Nonetheless, some do not even think about gold to be a financial investment whatsoever, instead a bush against inflation.

Of training course, as secure as gold may be considered, it still stops working to stay as eye-catching as realty. Here are a few factors capitalists choose property over gold: Unlike real estate, there is no financing and, for that reason, no area to utilize for growth. Unlike property, gold recommends no tax benefits.

Indicators on Amur Capital Management Corporation You Need To Know

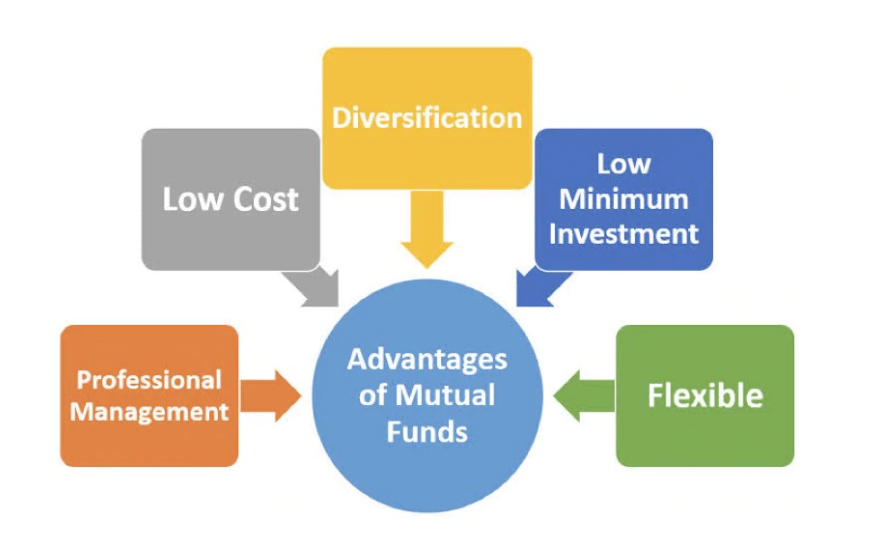

When the CD grows, you can gather the original investment, together with some rate of interest. Certificates of deposit do not appreciate, and they've had a historic ordinary return of 2.84 percent in the last eleven years. Realty, on the other hand, can appreciate. As their names suggest, shared funds include funds that have actually been merged with each other (investment).

It is among the most convenient methods to expand any portfolio. A shared fund's efficiency is constantly measured in terms of overall return, or the amount of the adjustment in a fund's net asset value (NAV), its returns, and its resources gains distributions over a provided time period. Nonetheless, similar to stocks, you have little control over the efficiency of your properties. https://www.tripadvisor.in/Profile/amurcapitalmc.

As a matter of fact, putting cash into a common fund is basically handing one's financial investment decisions over to a professional money manager. While you can pick your financial investments, you have little claim over just how they carry out. The three most common ways to purchase realty are as follows: Purchase And Hold Rehabilitation Wholesale With the most awful component of the recession behind us, markets have undergone historic appreciation rates in the last three years.

Indicators on Amur Capital Management Corporation You Need To Know

Purchasing reduced does not imply what it click site used to, and investors have actually acknowledged that the landscape is changing. The spreads that dealers and rehabbers have actually become familiar with are beginning to invoke memories of 2006 when values were traditionally high (mortgage investment corporation). Naturally, there are still numerous opportunities to be had in the globe of flipping property, yet a new exit strategy has actually become king: rental homes

Otherwise understood as buy and hold residential or commercial properties, these homes feed off today's appreciation prices and maximize the reality that homes are much more expensive than they were simply a few brief years ago. The principle of a buy and hold exit approach is basic: Investors will certainly want to raise their bottom line by renting out the building out and gathering monthly cash money flow or simply holding the residential property until it can be cost a later day for an earnings, certainly.

Report this page